In the fast-paced world of trading, managing risk is not just a smart strategy—it is essential. One of the most effective tools for managing risk in Forex and CFD trading is the use of stop loss and take profit orders. These tools help traders lock in gains and prevent excessive losses, ultimately improving long-term success rates in the financial markets.

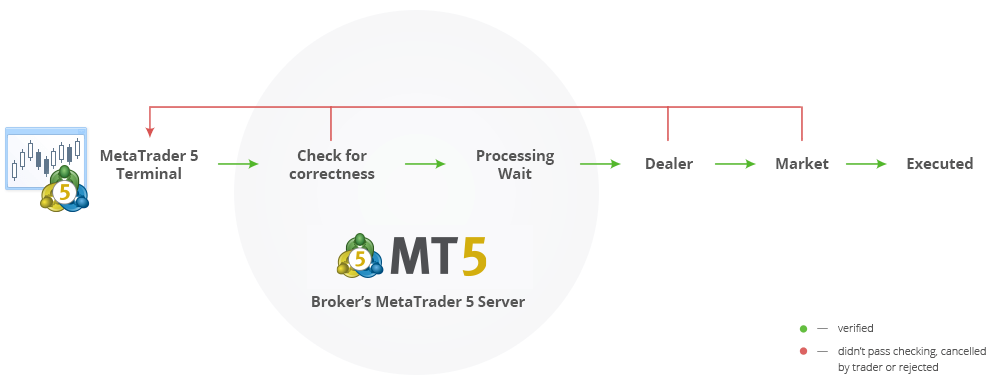

Trading platforms like MetaTader 5 provide advanced tools that allow users to implement stop loss and take profit functions with precision. MT5 integrates these risk controls seamlessly into order placements, giving traders a structured approach to trade execution and capital protection.

What Is Stop Loss?

A stop loss order is a risk management tool used to close a position automatically when the price moves against the trader’s expectations beyond a certain point. The main purpose of a stop loss is to prevent large losses by cutting off a trade before it becomes too damaging to the account balance.

For example, if a trader buys EUR/USD at 1.1000 and places a stop loss at 1.0950, the position will automatically close if the price falls to 1.0950, thereby limiting the loss to 50 pips.

What Is Take Profit?

A take profit order is used to automatically close a position when the market reaches a target price in the trader’s favor. This allows traders to secure profits without needing to monitor the market constantly.

Using the same example, if the trader sets a take profit at 1.1100, the position will automatically close when the price reaches that level, securing a 100-pip profit.

Why Are Stop Loss and Take Profit Orders Important?

1. Emotional Discipline

Many traders fall into the trap of letting emotions drive their decisions. Fear and greed can lead to poor choices, such as holding onto losing trades for too long or closing winning trades too early. Stop loss and take profit orders eliminate emotional interference by automating exits based on predefined levels.

2. Capital Protection

By using stop loss orders, traders ensure that a single bad trade doesn’t wipe out a large portion of their account. This is especially important for beginners who may not yet have the experience to recover from significant losses.

3. Consistent Trading Strategy

A well-thought-out trading plan should always include exit rules. Placing stop loss and take profit levels enforces consistency and helps traders stick to their strategies rather than making impulsive decisions based on market noise.

How to Set Effective Stop Loss and Take Profit Levels

There is no one-size-fits-all approach to setting stop loss and take profit levels, but here are some general strategies:

-

Technical Analysis: Use support and resistance levels, trendlines, and chart patterns to determine logical price points for stop loss and take profit.

-

Risk-Reward Ratio: Many successful traders use a fixed risk-reward ratio (e.g., risking 1% to gain 2%). This ensures that even if some trades are losses, the gains outweigh them over time.

-

Volatility-Based Stops: Some traders use Average True Range (ATR) or similar indicators to set stops and targets based on the instrument’s current volatility.

Integration in Trading Platforms

Modern platforms like MT5 make it easy to set and modify stop loss and take profit orders. Whether you are placing a market order or a pending order, MT5 allows you to define SL/TP levels at the time of entry and update them later if needed.

To better understand how these features work, and how they relate to different types of trades, you can explore the various Types of order in MT5. This resource breaks down how different orders interact with stop loss and take profit strategies, which is essential for fine-tuning your approach.

Common Mistakes to Avoid

-

Setting Stops Too Tight: A stop loss that’s too close to the entry point can get triggered by minor market fluctuations.

-

Not Using Stop Loss at All: Trading without a stop loss is highly risky and can result in large losses.

-

Unrealistic Take Profit Targets: Setting overly ambitious profit levels may result in missed opportunities or trades that reverse before hitting the target.

Conclusion

Stop loss and take profit orders are essential components of a sound trading strategy. They help manage risk, enforce discipline, and create consistency in trade execution. Regardless of experience level, every trader should incorporate these tools into their trading plan.

Platforms like MetaTrader 5 make the implementation of these features straightforward and efficient. With a solid understanding of stop loss and take profit usage, traders can better navigate market volatility and focus on long-term success.